Investment banking plays a crucial role in the financial landscape of Nepal, facilitating economic growth, and providing essential financial services to businesses, government entities, and individuals. In this blog post, we will explore the significance of investment bankers in Nepal and their contributions to the development of the country’s economy.

What is an Investment Banker in Nepal

An investment banker is a financial professional who works in the field of investment banking. They play a crucial role in facilitating various financial transactions and providing advisory services to clients, including corporations, governments, and individuals. Investment bankers are experts in analyzing financial markets, assessing investment opportunities, and executing complex financial transactions.

Here is an overview of the primary functions and responsibilities of an investment banker:

Financial Advisory:

Investment bankers provide strategic financial advice to clients, assisting them in making informed decisions regarding mergers and acquisitions, corporate restructuring, and capital raising. They evaluate the financial viability of potential transactions, conduct valuation analyses, and offer recommendations to maximize value and minimize risks.

Capital Raising:

One of the key functions of investment bankers is to help companies raise capital to finance their operations, growth, or specific projects. They assist in issuing securities such as stocks, bonds, and other financial instruments to attract investors and generate funds for their clients. This process involves underwriting, pricing, and marketing securities to potential investors.

Mergers and Acquisitions (M&A):

Investment bankers play a pivotal role in facilitating mergers, acquisitions, and divestitures. They help clients identify potential acquisition targets or buyers, conduct due diligence, negotiate terms, structure the transaction, and manage the overall process. Their expertise in valuation, financial modeling, and deal structuring ensures smooth and successful M&A transactions.

Initial Public Offerings (IPOs):

Investment bankers assist companies in going public through Initial Public Offerings (IPOs). They help the issuing company determine the offering price, prepare the necessary legal and financial documentation, coordinate with regulatory authorities, and market the IPO to institutional and retail investors.

Risk Management:

Investment bankers provide risk management services to clients, helping them identify, assess, and mitigate financial risks associated with their investments and operations. They employ various risk management techniques and financial instruments to hedge against market volatility, interest rate fluctuations, and other potential risks.

Market Research and Analysis:

Investment bankers continuously analyze financial markets, economic trends, industry sectors, and specific companies to provide clients with valuable insights and investment recommendations. They conduct extensive research, gather data, and prepare detailed reports and presentations to support investment decisions.

Client Relationship Management:

Building and maintaining strong relationships with clients is crucial for investment bankers. They act as trusted advisors, understanding their client’s financial goals, risk appetite, and specific needs. Investment bankers provide personalized solutions, develop long-term relationships, and deliver high-quality service to ensure client satisfaction and loyalty.

It’s important to note that the specific functions and responsibilities of investment bankers may vary based on their specialization, such as corporate finance, mergers and acquisitions, or capital markets. Additionally, investment bankers collaborate closely with other professionals, including lawyers, accountants, and regulatory authorities, to ensure compliance with legal and financial regulations.

Brief History and Evolution:

Investment banking in Nepal has witnessed significant growth and development over the years. While the industry has a relatively short history compared to more established markets, it has been instrumental in supporting the country’s economic progress.

The establishment of the Nepal Stock Exchange (NEPSE) in 1993 played a crucial role in shaping the investment banking landscape. Initially, investment banking activities were primarily focused on stockbroking services and facilitating securities transactions. However, as the Nepalese economy expanded and diversified, investment banks began offering a broader range of financial services to meet the growing demands of businesses and investors.

Regulatory Framework and Key Players:

The regulatory framework for investment banking in Nepal is primarily governed by the Securities Board of Nepal (SEBON). SEBON acts as the regulatory authority responsible for overseeing and regulating securities markets, including investment banks and other market participants.

Key players in the Nepalese investment banking industry include both domestic and international financial institutions. Some of the prominent investment banks in Nepal include:

- Nabil Investment Banking Ltd.

- Global IME Capital Limited

- Citizens Investment Trust

- NIBL Ace Capital Limited

- Prabhu Capital Limited

- Sunrise Capital Limited

- Agricultural Development Bank Nepal

- Development Credit Bank Ltd.

- Everest Bank Limited

- Himalayan Bank Ltd

- Lumbini Bank Limited

- Nepal Industrial & Commercial Bank Ltd.

- Nepal Rastra Bank

- Rastriya Banijya Bank

These investment banks provide a wide range of services to cater to the diverse needs of clients in Nepal.

Structure of the Nepalese Financial System

There are many different kinds of institutions that carry out distinct tasks in Nepal’s financial system. Commercial banks, development banks, finance companies, and microfinance institutions (MFIs) are some of the financial institutions that accept deposits. These organizations offer numerous banking services as well as accepting personal deposits.

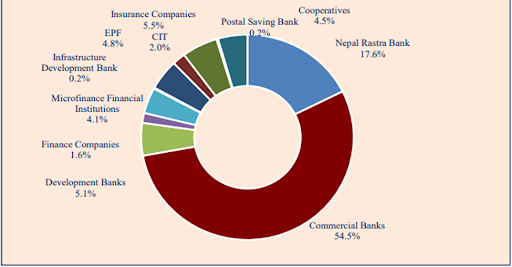

Commercial banks make up the greatest portion of Nepal’s financial system, accounting for 54.5 percent of all assets. Deposit accounts, loans, foreign exchange services, and other financial goods are just a few of the many services they provide. Development banks concentrate on offering long-term finance for businesses and infrastructure initiatives. Finance firms mostly provide credit and loans to private citizens and small enterprises. MFIs are experts at giving low-income people and disadvantaged areas access to financial services including microloans and microinsurance.

Along with deposit-taking institutions, Nepal’s financial system also includes cooperatives, non-governmental organizations (NGOs) that engage in restricted banking activities, insurance firms, employee’s provident funds, citizen investment trusts, postal savings offices, and the Nepal Stock Exchange.

The central bank and regulating body for the banking industry in Nepal is the Nepal Rastra Bank (NRB). Commercial banks, development banks, finance businesses, and MFIs are all under its supervision and regulation. The formation of monetary policy, oversight of the banking industry, and preservation of the nation’s financial stability are among the NRB’s key duties.

As of mid-March 2022, the financial system in Nepal comprised 27 commercial banks, 17 development banks, 17 finance companies, 66 MFIs, and 1 infrastructure development bank licensed by the NRB. Commercial banks held the largest share of assets at 54.5 percent, followed by the NRB with 17.6 percent. Development banks, finance companies, and MFIs accounted for 5.1 percent, 1.6 percent, and 4.1 percent of the assets, respectively.

On the non-bank side, insurance companies held a 5.5 percent share of the financial system’s assets, while cooperatives accounted for 4.5 percent. These institutions play an important role in providing financial services and facilitating economic growth in Nepal.

Types of investment banks in Nepal?

The word “investment bank” is not frequently used in Nepal in the same sense that it is in some other nations. However, there are financial institutions in Nepal that offer services similar to what investment banks in other countries do. Most commonly, these organizations fall under the merchant bank or development bank categories.

- Merchant banks: In Nepal, merchant banks offer services including underwriting, issuing, and dispersing securities. Additionally, they provide portfolio management, financial restructuring, corporate consulting services, and mergers and acquisitions (M&A) advice services. In Nepal, capital market operations are greatly facilitated by merchant banks.

- Development Bank: In Nepal, development banks are primarily concerned with providing long-term finance for businesses, industries, and other types of growth-related initiatives. The expansion of industries including manufacturing, tourism, agriculture, and energy is significantly aided by and supported by these banks. Financial advice, project finance, and investment banking services are frequently offered by development banks to aid with economic growth.

Services Offered by Investment Bankers:

Investment bankers in Nepal offer a comprehensive range of financial services to individuals, corporations, and government entities. Some of the services provided by investment bankers in Nepal include:

Capital Raising:

Investment bankers assist businesses in raising capital through various means, such as initial public offerings (IPOs), rights issues, and private placements. They help clients navigate the regulatory requirements, structure the offering, determine the appropriate valuation, and coordinate with stakeholders throughout the capital-raising process.

Mergers and Acquisitions (M&A) Advisory:

Investment bankers play a vital role in facilitating mergers, acquisitions, and divestitures in Nepal. They provide advisory services throughout the transaction, including target identification, due diligence, valuation, deal structuring, and negotiations. Investment bankers help clients navigate complex M&A transactions and maximize value for all parties involved.

Underwriting:

Investment banks act as underwriters for companies issuing securities. They assume the risk of purchasing unsold shares or bonds and ensure the successful completion of the offering. Underwriting services provide a level of assurance to companies looking to raise funds in the capital market.

Corporate Finance Advisory:

Investment bankers offer strategic financial advice to companies on matters such as corporate restructuring, financial planning, and risk management. They help businesses optimize their capital structure, improve financial performance, and identify growth opportunities.

Research and Analysis:

Investment banks in Nepal conduct extensive market research and analysis to provide insights and investment recommendations to clients. They publish research reports, assess market trends, and analyze economic indicators to assist investors in making informed decisions.

Debt and Equity Financing:

Investment bankers help clients raise debt and equity financing from domestic and international sources. They assist in structuring financing solutions, negotiating terms, and facilitating the disbursement of funds.

These are just a few examples of the services offered by investment bankers in Nepal. As the financial industry continues to evolve, investment banks adapt to new market dynamics and expand their service offerings to meet the changing needs of clients.

You May Also Like this:

- List of Insurance Companies in Nepal-Updated 2023

- Real Estate Investment: Maximizing Returns and Future Growth

- Understanding Insurance Premium Tax in Nepal: A Comprehensive Guide

Capital Raising and Corporate Finance Advisory Services:

Investment bankers in Nepal assist businesses in raising capital through various means, such as equity offerings, debt financing, and hybrid securities. They provide guidance on capital structure optimization, evaluate financing options, and offer strategic advice on the most suitable approach to meet the company’s financial objectives. Investment bankers also help clients assess the costs and benefits of different capital-raising methods, conduct valuation analyses, and navigate regulatory requirements.

Underwriting and Initial Public Offerings (IPOs):

Investment bankers play a crucial role in underwriting securities issuance, including Initial Public Offerings (IPOs). They act as intermediaries between the issuing company and potential investors, assuming the risk of purchasing unsold shares or bonds. Investment bankers assist companies in preparing for an IPO, structuring the offering, determining the offering price, and marketing the securities to institutional and retail investors. Their expertise in valuation, market analysis, and regulatory compliance helps ensure a successful IPO.

Mergers and Acquisitions (M&A) Advisory:

Investment bankers provide M&A advisory services to clients interested in buying or selling businesses. They facilitate the entire M&A process, starting from identifying potential targets or buyers, conducting due diligence, and valuing the business. Investment bankers assist in negotiating deal terms, structuring the transaction, and coordinating with legal and financial advisors. Their expertise in financial analysis, deal structuring, and industry knowledge helps clients navigate complex M&A transactions and maximize value.

Debt and Equity Financing Solutions:

Investment bankers assist companies in securing debt and equity financing to fund their operations, expansions, or strategic initiatives. They help structure financing solutions, negotiate terms with lenders or investors, and manage the documentation and closing processes. Investment bankers evaluate the financial position of the client, assess the risk appetite of potential lenders or investors, and identify the most appropriate sources of debt or equity funding.

Financial Restructuring and Risk Management:

Investment bankers provide financial restructuring services to companies facing financial distress or seeking to optimize their capital structure. They analyze the company’s financial position, assess debt sustainability, and propose restructuring strategies to improve liquidity, reduce debt burden, or renegotiate terms with creditors. Additionally, investment bankers assist clients in identifying and managing financial risks through risk analysis, hedging strategies, and the use of derivative instruments.

In summary, investment bankers in Nepal offer a range of services encompassing capital raising, corporate finance advisory, underwriting, IPOs, M&A advisory, debt and equity financing solutions, financial restructuring, and risk management. Their expertise and guidance in these areas enable businesses to access funding, execute transactions, and navigate complex financial challenges effectively.

Supporting Economic Growth:

Facilitating Capital Investment and Funding for Businesses:

Investment bankers in Nepal play a vital role in facilitating capital investment and funding for businesses. They help connect businesses with potential investors, assist in raising capital through equity and debt financing, and provide guidance on financial strategies to support growth and expansion.

Enhancing Access to Financial Markets for Companies:

Investment bankers help companies access financial markets by providing advisory services on listing requirements, regulatory compliance, and market entry strategies. They assist in navigating the complexities of the capital market, facilitating companies’ ability to raise funds, and increasing their visibility among investors.

Contributing to the Development of the Capital Market Infrastructure:

Investment bankers contribute to the development of Nepal’s capital market infrastructure by promoting transparency, liquidity, and efficiency. They actively participate in market activities, including trading, underwriting, and market-making, which help in the growth and stability of the overall market.

Promoting Foreign Direct Investment (FDI) through Strategic Partnerships:

Investment bankers play a role in attracting foreign direct investment to Nepal by forging strategic partnerships with international investors and companies. They provide market insights, and advisory services, and assist in navigating legal and regulatory frameworks, thereby facilitating the entry of foreign investors and promoting economic development.

Investment Banking Career Opportunities in Nepal:

-

Skills and Qualifications Required:

To pursue a career in investment banking in Nepal, individuals should possess strong analytical skills, financial acumen, and knowledge of capital markets. They should have a solid understanding of financial modeling, valuation techniques, and risk management. Strong communication and interpersonal skills are also essential to effectively engage with clients and stakeholders.

-

Growth Potential and Opportunities:

The investment banking sector in Nepal offers promising career growth opportunities. As the economy expands and financial markets mature, the demand for investment banking services continues to grow. Professionals in this field can progress through various roles, including analyst, associate, and senior management positions, with opportunities to specialize in areas such as corporate finance, M&A, or capital markets.

-

Training and Development Programs:

Aspiring investment bankers can benefit from training and development programs offered by financial institutions, industry associations, and professional training providers. These programs cover areas such as financial analysis, investment banking principles, regulatory compliance, and industry-specific knowledge. Gaining professional certifications, such as CFA (Chartered Financial Analyst) or ACCA (Association of Chartered Certified Accountants), can also enhance career prospects.

Challenges and Future Prospects:

-

Addressing Regulatory and Legal Challenges:

Investment banking in Nepal faces regulatory and legal challenges, including compliance with evolving securities laws, governance standards, and risk management requirements. Regulatory bodies and market participants need to work together to ensure a robust regulatory framework that fosters investor confidence and market stability.

-

Embracing Technological Advancements and Digitalization in the Industry:

Investment banks in Nepal should embrace technological advancements and digitalization to enhance operational efficiency, improve client experiences, and facilitate faster and more secure transactions. Utilizing technologies like artificial intelligence, data analytics, and blockchain can streamline processes, automate routine tasks, and enable better risk management.

-

Expanding the Scope of Investment Banking Services:

To further develop the investment banking sector, there is a need to expand the scope of services beyond traditional areas. This can include introducing specialized services like sustainable finance, impact investing, and providing advisory support to sectors like renewable energy, infrastructure development, and innovation-driven industries.

Frequently Asked Questions (FAQs): Investment Bankers in Nepal

What is an investment banker in Nepal?

What are the functions of an investment banker?

What is the role of an investment banker in Nepal?

What is the average salary of an investment banker in Nepal?

What is the process of an investment banker's work in Nepal?

What are the bonuses associated with being an investment banker?

How much can an investment banker earn in Nepal?

How do investment banks in Nepal operate in 2023?

What changes can we expect in investment banks in 2024?

Conclusion:

Investment bankers in Nepal play a vital role in facilitating economic growth, supporting businesses, and providing essential financial services. Through their expertise in capital raising, financial advisory, and risk management, investment bankers contribute to the development of the country’s economy. As Nepal continues to progress, investment banking is poised to play an even more significant role in attracting investment, promoting innovation, and driving sustainable economic development.