Blockchain in insurance is the future, providing strong data security with powerful encryption methods. It is a distributed database system and a technology in which the records and transactions of customers can be stored, retrieved, exchanged, and verified without the control of a central party. The insurance industry’s perception of blockchain is evolving from time to time. There are a lot of benefits that blockchain in insurance provides and the working of blockchain in insurance is also simple and less complicated than other database systems.

How does Blockchain work?

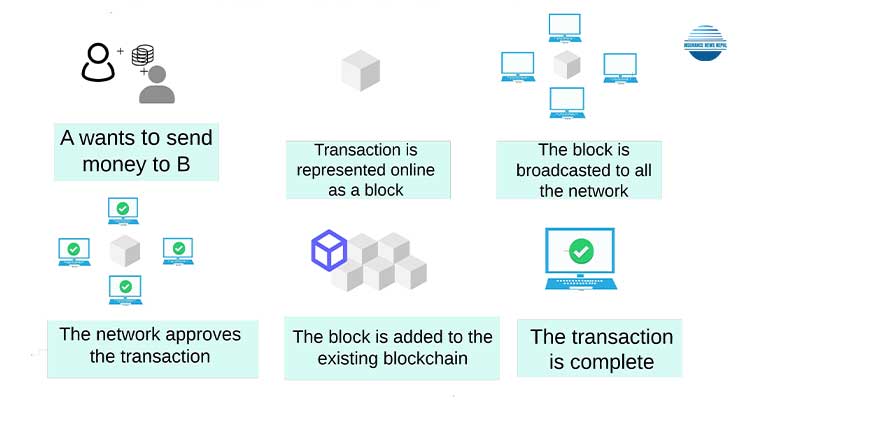

The transactions and records of blockchain are distributed and maintained on many different computers that are interconnected. In blockchain technology, the transaction is requested by a certain customer digitally.

The transactions and records of blockchain are distributed and maintained on many different computers that are interconnected. In blockchain technology, the transaction is requested by a certain customer digitally.

As information is provided by the customers the transactions are recorded and the network of nodes uses a known algorithm to validate the transaction and the user status. The verified transactions can involve contracts, records, information, etc. Then these transactions are combined with other transactions once verified to create a new block of data for the ledger. Then the new block is added to the existing blockchain (i.e. unalterable and permanent)

Hence, as any new information is added, each new “block” is formed and that block is “chained” to the previous one in a permanent and unalterable sequence using advanced cryptography.

Cryptography is the technique of securing communications and information by using codes that prevent the third party or the public from reading private messages.

Importance of Blockchain in insurance

- Automation for insurance :

Blockchain in insurance provides a smart way to carry out contracts. The smart contract could be used to automatically pay claims in case of any accidents. This technology results in no need for an insurance agency or middleman.

- Cyber security for Insurance :

Secure insurance information is another benefit of this technology. Blockchain in insurance creates unalterable records of transactions which shut out fraud and unauthorized activity. It stores the data across the network in such a way making it impossible to hack. Furthermore, it is better than a traditional computer system.

- Stability of insurance:

This technology reduces the unstable condition of the insurance. We can keep the transactions recorded via smart contracts which is another beneficial feature of Blockchain in insurance. It enables the sharing of data within an ecosystem.

- Reduced Cost:

Blockchain in insurance reduces the mutual tasks and creates efficiency in processing transactions. Experts have pointed out that the blockchain’s ability to streamline clearing and settlement translates directly into cost savings. The fewer different modes of working and processing of the transactions, the less will be the cost.

- Lower total cycle time :

As it gives a digital way for customers’ insurance forms and transactions it takes less time to do the overall operation at a time. Customers can understand the policies and rules regarding insurance in real-time.

- Fraud Detection:

This technology provides a very safe and effective way for businesses to verify documents such as insurance policies, medical records, other insurance information, etc. This ability ensures that you get accurate information about the customer and that you are fully protected against any fraudulent claims or actions taken by the fraud customers.

- Integration of data :

Blockchain in insurance combines all the chains in the database and presents it as a single unified view. By verifying the authenticity of claims it helps many insurers to maintain the data integrity. Commonly this helps companies to generate insights into their customers’ risk profiles.

You May Also like:

- Unleashing the Power of Stock Market Investment: A Comprehensive Guide

- Mutual Fund Investment in Nepal

- AGI Calculator

Frequently Asked Questions (FAQs):

Why is blockchain important in the insurance industry?

What is Blockchain?

How is blockchain implemented in insurance?

How can blockchain impact claims handling?

What are the benefits of blockchain?

What is cryptography and how it works?

Conclusion

Many insurance companies are already experimenting with radical new products for the dynamic evolution of insurance customers in the modern and digital age. Blockchain in insurance reveals easy and fast ways to collect data and store them securely. It is important to understand the workings and benefits of recognizing the hype going around for the Blockchain. In the insurance industry, it facilitates result in smart contracts and digital payment.