In the share market, there are two main types of markets: the primary market and the secondary market. The primary market is just for the IPO issuing whereas the secondary market is the real stock market.

In this blog, we will explore the process of buying and selling shares in Nepal, providing an overview of how the share market operates in Nepal.

[ez-toc]

Primary Market:

New securities are issued and sold in the primary market for the first time. This process is known as an Initial Public Offering (IPO). Companies use the primary market to buy and sell shares in Nepal to the public. Investors can participate in the IPO and become shareholders of the company. Shares that the corporation directly issues in the primary market are:

- IPO(initial public offer)

- FPO(further public issue)

- Right and bonus share

Secondary Market:

The secondary market, also known as the stock exchange, is where existing securities are bought and sold among investors without the involvement of the issuing company. It provides liquidity to investors by allowing them to trade stocks freely.

A secondary market is one where investors trade stocks/shares among themselves. Once you have a DEMAT account, now let’s say you want to buy stocks/shares of XYZ company, but the XYZ company is not open for IPO i.e. company is not offering any shares in the primary market. To buy the shares of XYZ Company, you have to go to a broker’s office to buy shares which is the secondary market. To choose the best shares to buy in Nepal, carefully analyze the fundamentals of a company.

How can I buy and sell shares in Nepal?

To sell your shares you must have a TMS account (Broker account) as you cannot buy and sell shares using the mero share or DEMAT account. Your shares are stored in the DEMAT account, which works similarly to a bank account. Meroshare account is made especially for settling transactions and submitting applications for initial public offerings (IPOs).

- Bank account

- DEMAT Account(from the same bank is advised).

- Broker Account (most important)

Make a DEMAT account if you don’t already have one. Open a broker account with any licensed broker in Nepal by going to the broker’s office to trade shares online. Complete the form to finalize the KYC verification. Only after the broker has confirmed the KYC is online trading enabled.

Online and offline trading are both possible. Select an online account if you want to trade online; if you have an offline account, you can only trade through a broker. After confirming the KYC form, the broker creates the investor’s account in the Trading Management System (TMS) and emails the investor’s login and password to the address they have provided.

By changing the password, investors can trade by logging in to the broker account. The TMS login will also be provided by the broker’s office.

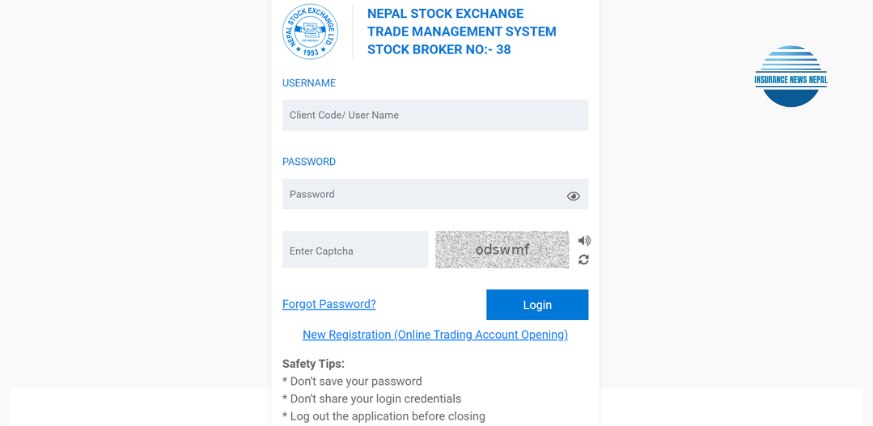

To visit the TMS login, Go to your Broker’s website and click TMS USER LOGIN. Or you can search by your broker no on Google. For example, Broker No. 38.

There are more than 50 licensed brokers in the market. You can visit the login page by directly searching the broker name or number.

TMS LOGIN PROCESS

1. Login Page

After you open the TMS login page, enter your username and password then enter capha and press login.

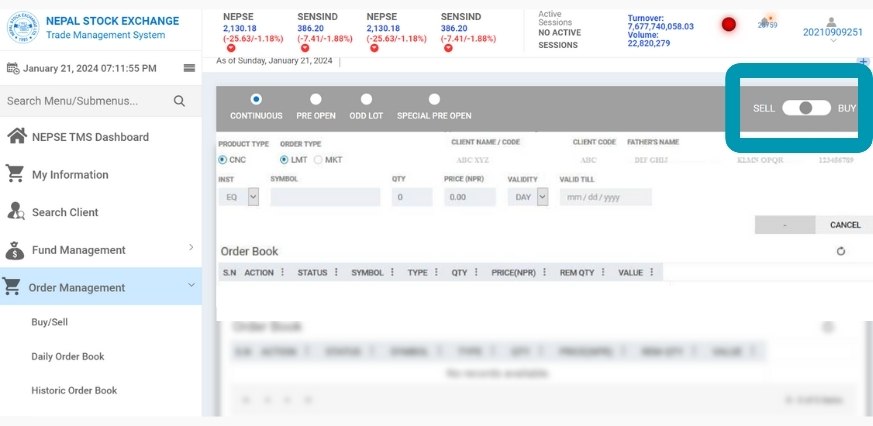

2. TMS Dashboard

This is the TMS dashboard after the login process.

3. Buy and sell shares

Click on buy or sell under order management on the left to post an order. A screen for order entry will then show up. Click buy if you want to buy, and click sell if you want to sell.

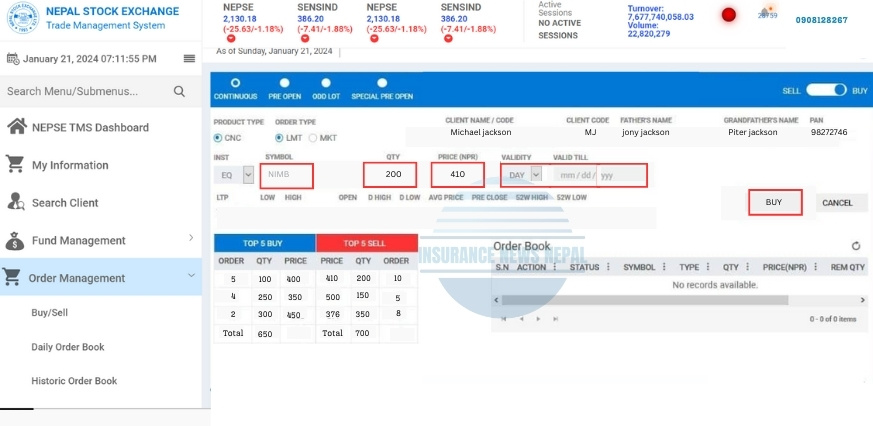

4. Buying Shares

Click Buy in the upper right corner if you wish to purchase. When you choose “BUY”, a blue screen dashboard will show up.

Choose ‘Equity’ as the share type. Enter the stock symbol to choose the company. On the same order page, enter the desired price and the number of shares depending on the displayed price range and click “BUY.”

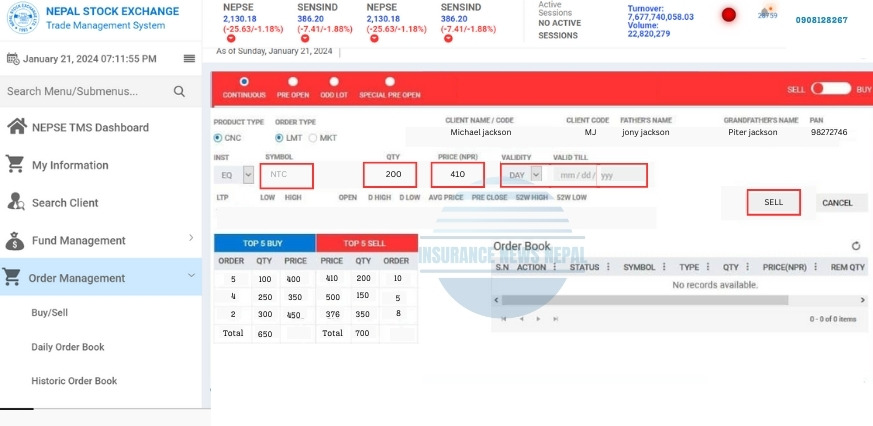

5. Selling Shares

To sell your shares, do the same and click “Sell” in the upper right corner of the screen. When you select “Sell,” a red dashboard will show up.

Enter the number of shares, the selling price, and the stock symbol in the same manner as before. After that, select “Sell”.

Note: You can make changes or cancel your order if any trader has not placed the order to buy or sell the stocks at the same price you have placed the order. To make changes go to Order Management, and in the Order Book section, you can modify and delete. Choose “Modify” next to your order to adjust the quantity or price for buying or selling. After making changes, click “Place Order” to continue or “Cancel” to stop the transaction.

You may also like:

- How many days will it take to credit allotted shares on the demat account in Nepal

- Best Shares to Buy in Nepal

- Can a Nepali citizen invest in foreign shares

Conclusion

In conclusion, the share market has two main parts: the primary market issues new securities like IPOs, while the secondary market involves buying and selling existing securities. To trade shares in Nepal, get a bank account, a DEMAT account (preferably from the same bank), and a broker account. Online trading involves logging into the broker’s system, selecting buy or sell, entering details, and allowing for order modifications or cancellations