Right shares are issued by any company to raise capital and right share can only be issued after the company has issued an IPO of the company previously. To apply for the right share of any company you already need to have a share of that specific company. You will learn in detail how to apply the right shares in this blog.

[ez-toc]

What are the right shares?

Right shares are newly issued stock sold to current stockholders at a price lower than the going rate. Based on their current holdings, each shareholder has the “right” to buy a certain number of additional shares.

The Securities Act of 2006 and guidelines established by the Securities Board of Nepal (SEBON) control the issue of right shares in Nepal. The issuance procedure, eligibility requirements, and shareholder rights are all outlined in these regulations.

In Nepal, businesses usually offer the right shares to raise money for investments, debt repayment, or business expansion. For such issuances, SEBON clearance is required, guaranteeing regulatory control.

What should you look for while applying for the right share?

- Issue price

- The ratio of new shares to existing shares

- Subscription dates

- Payment methods

- Required documents (e.g., Demat account details, existing shares of a company)

Select your application method

You can apply for the right shares using the given methods:

- Through the broker: Usually, your registered broker is the one you apply to.

- Issuer’s office: It may be possible to apply directly in some situations.

- Online method: Login into your Meroshare account.

How do you apply for the right share through Meroshare Asba?

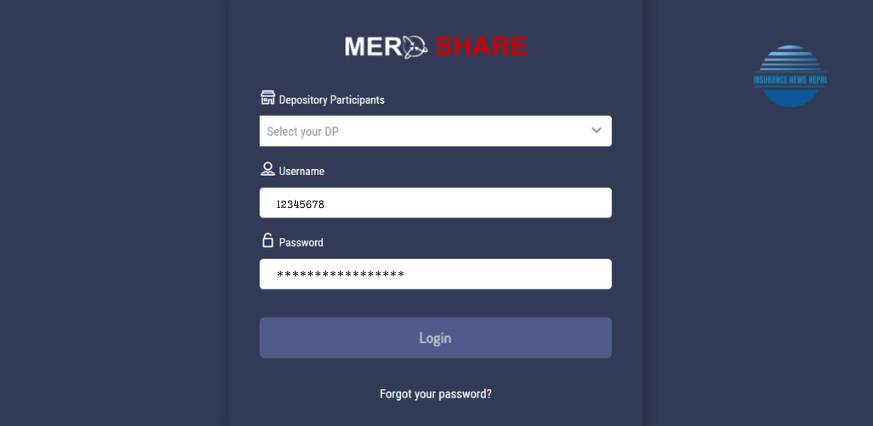

Step 1: Visit the Mero Share website. Enter your “Depository Participant”, “Username” and “Password” to log in to your account.

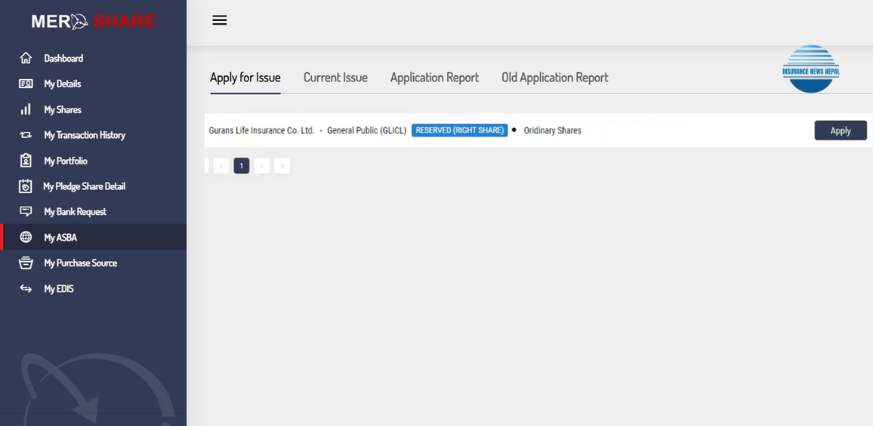

Step 2: After login, you will see the dashboard as below. Click on “My ASBA“. Click on “Apply for Issue”, there, you will find your current shares that are available for Right shares. Click on “Apply“.

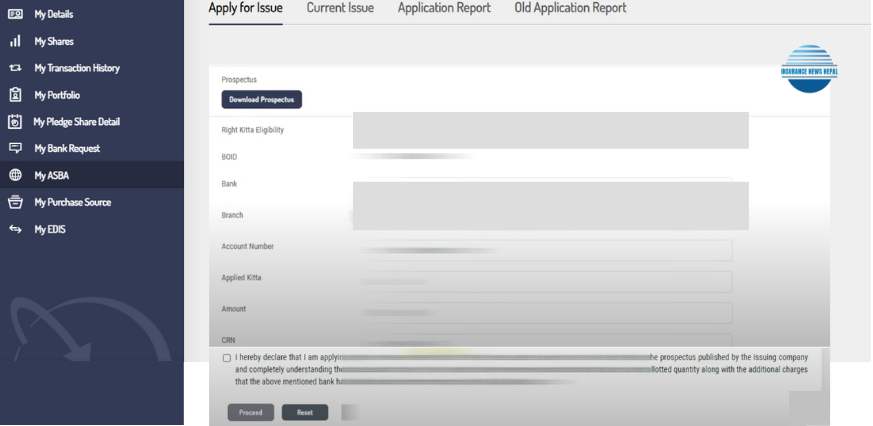

Step 3: Click on ‘Download Prospectus’ to get more information on the share.

Step 4: Check the number of “Right Kitta Eligibility“. you wish to apply for.

Step 5: Enter your “BOID” no. Then select your “Bank“, branch name, and “Account number”.

Step 6: Select the number of right shares you want to purchase on the ‘Applied Kitta’ selection.

Step 7: Write your CRN number in the ‘CRN’ section.

Step 8: Click on the check box below and click on ‘Proceed’.

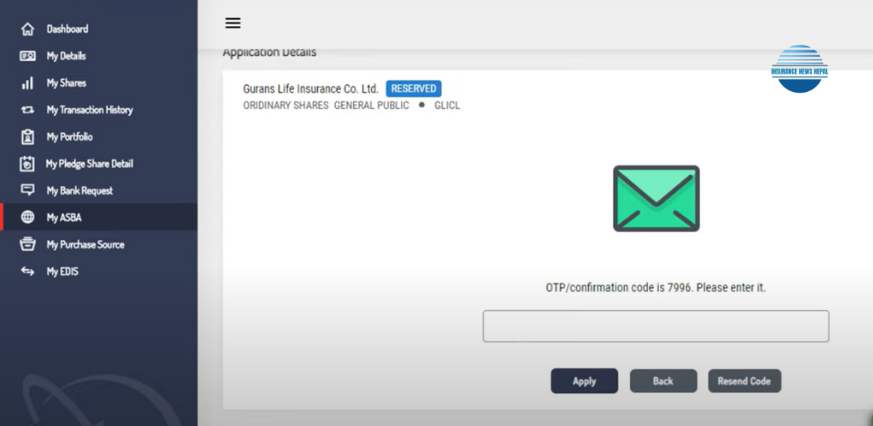

Step 9: Then you’ll receive the OTP or confirmation code.

Step 10: Enter your OTP code on the page where they ask you for your OTP code and click on ‘Apply’. You’ll receive a ‘Your share has been applied.’ notification. Now your right share buying process is completed.

How Many Right Shares Can I Apply For?

When a company offers rights shares, it specifies a ratio that determines how these shares can be obtained. For instance, Gurans Life Insurance released rights shares with a ratio of 15:5. This indicates that for every 5 shares owned, you can request 15 more shares. Thus, if you presently hold 100 shares of Gurans Life Insurance, you have the opportunity to buy 300 additional shares at the designated price.

let’s break down the calculation:

Given:

- Ratio of rights shares: 15:5

- Number of shares owned initially: 100

To calculate the number of additional shares eligible to purchase:

1. Determine how many groups of 5 shares are contained within the initial holding of 100 shares:

Number of groups = 100/ 5

=20

2. Multiply the number of groups by the corresponding number of rights shares in the ratio (15):

Additional shares eligible =20×15

=300

So, if you have 100 shares of Gurans Life Insurance, you are eligible to purchase an additional 300 shares through the rights offering.

What is the impact of the right share?

Dilution: When new shares are introduced at a discounted price, right shares may cause dilution of ownership of current shareholders.

Market Price: Because of the additional supply, the market price of existing shares may initially decline. Long-term consequences, however, are contingent upon the performance of the company and the efficient use of resources.

Subscription: Shareholders may choose to subscribe for the shares that correspond to their allotted rights, sell those rights on the open market, or allow their rights to expire.

Assume a Nepalese firm has 300 shares owned by a shareholder. The business announces offering the right shares at a 20% discount. The shareholder is faced with an option: they can sell their market rights, let them expire, or buy 60 additional shares at a discounted price. The shareholder can purchase more shares at a lower cost than the going rate when the 20% discount is applied.

You may also like:

- How does the share market work in Nepal

- Can a Nepali citizen invest in foreign shares

- How do I know the IPO allotment time on the date of the allotment

FAQs

What are the right shares, and how do they work?

How do I apply for the right shares?

What are the potential impacts of right shares?

Conclusion

In short, right shares are a way for companies to raise capital by offering existing shareholders the chance to buy more shares at a discount. When applying, investors need to consider factors like price, subscription dates, and payment methods. Right shares can impact ownership, and market price, and provide options for shareholders. For example, if a Nepalese firm offers a 20% discount, shareholders could buy additional shares at a lower cost or explore other options with their rights.